value adding ESG - reporting

What is an ESG - reporting standard?

Triple Bottom Line Reporting—integrated sustainability through Ecology, Social Responsibility, and Governance.

In sustainability, it's not about choosing between ecological, social, or economic goals—it’s about addressing all three together. ESG reporting standards provide structured guidance on how to

evaluate and communicate each aspect of Environmental, Social, and Governance performance.

These frameworks define:

- What data should be collected and how it’s compared

- Which components are mandatory, and which are voluntary

- Examples include the GRI Standards, EU CSRD/ESRS, EU VSME, and the Common Good Balance Sheet, among others.

- ESG standards act as a neutral, shared language and measurement logic for sustainability topics ´not to be confused with various eco or ethics labels.

(c) FM

Why public sustainability reporting matters—and why using recognized standards adds real value.

A well-founded sustainability report pays off in multiple ways:

- 🌿 Customer relevance Clear, credible statements on ESG topics are increasingly a must-have for both B2C and B2B clients. They save time and effort by reducing repetitive data requests and reinforce trust through transparency.

- 👥 Employer branding impact Strong and visible commitments to sustainability—backed by data and clear goals—resonate with today’s applicants and strengthen your appeal as a responsible, future-oriented employer.

- 💰 Investor and financing credibility Banks and investors actively assess ESG data to mitigate credit risk and fulfill stakeholder expectations. For many, sustainability is not just a checkbox—it’s a personal priority.

- 📈 Strategic alignment through triple bottom line thinking Public reporting helps embed key environmental, social, and governance dimensions directly into your operational strategy. It supports progress in areas that are objectively important and economically viable.

Choosing a recognized reporting standard tailored to your industry simplifies ESG communication. It acts as a shared language for sustainability—building trust, enabling fair assessments, and avoiding apples-to-oranges comparisons. By using a framework that aligns with your sector, you ensure that your ESG data speaks clearly to customers, partners, and stakeholders.

which standard is suitable for our organization?

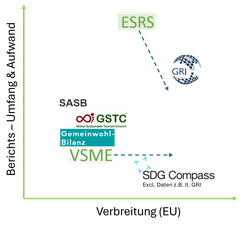

Simplified: scope, effort (y) versus EU based adoption (x) of selected ESG reporting standards. (c) FM

Choosing the right ESG framework - guided by practical questions and strategic relevance. Selecting the best-fit ESG reporting standard depends on several key considerations:

- 🧾 Are we legally required to adopt a specific standard? (For example, CSRD/ESRS applies to many EU-based organizations.)

- 🏭 Which framework is widely used in our industry? (Examples include GSTC or national ecolabels in tourism.)

- 📊 Does the framework support the types of analysis our clients expect? (Industry B2B sectors often align with VSME, GRI, or ESRS.)

- 🔍 Does it sufficiently address areas where we see room for improvement? (Some frameworks, like VSME, are rather limited in scope.)

- 📢 Does it help simplify and enhance our public communication? (Many organizations use SDGs as a clear visual anchor for communication.)

- ⚙️ How manageable is the implementation effort? (VSME is often easier to handle in terms of workload.)

- 📈 Looking ahead: VSME adoption is expected to grow significantly in the near future, while the administrative burden for ESRS is set to decrease by the end of 2025 due to updated EU guidelines.

From Impacts, Risks, and Opportunities to Solutions and Strategy.

Sustainability as a driver of innovation—problems spark creativity.

- Whether based on a materiality analysis or inspired by discussion around the SDGs, sustainability topics naturally reveal key ecological, social, and economic challenges. These challenges often spark spontaneous solution ideas from teams and stakeholders.

- Structured workshops further help uncover targeted solutions. Design Thinking is a proven method for this. But beware: the best innovations often stem from ideas we choose not to pursue.

- Overload of ideas without clear prioritization can stall progress - quick wins aside. That’s why strategic filtering is essential.

- We test the most promising concepts using minimum viable products (MVPs) - quick, simple versions in limited market segments. What works gets refined and scaled. What doesn’t gets dropped early (fail fast, learn faster).

- This approach strengthens goal-setting and strategy, grounded in real problems, relevant initiatives, and - in many cases - existing solution efforts.

Quelle: Google Trends

Suchanfragen zum Thema sustainability weltweit, 2016 - heute

selected ESG standards

As legal ESG requirements continue to increase globally, public interest in sustainability remains strong.

Below is a selection of relevant sustainability standards within the EU—not exhaustive:

VSME – Voluntary ESG Reporting Standard for SMEs

Designed for EU-based companies with up to 250 employees, the VSME offers a streamlined approach to sustainability reporting.

- ✅ Voluntary use The Basic Module (B1–B11) is mandatory when applying the standard, and can be extended with the Comprehensive Module (C1–C9).

- 📊 Lean structure, full flexibility The VSME is slim enough to allow easy collection of status quo data before evaluating initiatives and measures. As external consultants, we help tailor the reporting depth to your needs—and can provide expert input on selected topics to reduce effort.

- 🔗 Compatibility with CSRD/ESRS VSME content is largely aligned with CSRD/ESRS. A VSME report is typically sufficient to satisfy ESG data requests from B2B clients reporting under ESRS. However, some areas—such as stakeholder and community impact—are only lightly covered.

- 🧮 Reporting tools: Reports can be created using EFRAG’s Excel template, with an optional XBRL converter for digital signature and machine-readable XHTML. For environmental topics, an ESG software tool is highly recommended for efficient data handling.

- 🏢 Also useful for larger companies VSME may be suitable for larger organizations unsure about future CSRD/ESRS obligations—especially in light of potential changes under the EU Omnibus regulation.

-

💡 Simple, cost-effective entry point Developed by EFRAG on behalf of the EU, VSME is currently one of the most accessible way for SMEs to begin ESG reporting, strengthen strategic positioning, and respond to B2B client requests. VSME - voluntary reporting standard for SMEs

CSRD / ESRS – Corporate Sustainability Reporting Directive & European Sustainability Reporting Standards

- Starting with the 2024 reporting year, CSRD applies to many public interest entities and corporations with over 1,000 employees, €50M+ in revenue, or €25M+ in total assets. For other companies, future obligations remain unclear due to pending changes under the Omnibus Directive and incomplete national legislation (e.g. Austria).

- ⚠️ Important update: The ESRS framework is currently under revision, with a goal to reduce reporting effort by 50% by July 2025. A public feedback phase will follow until September, and Version 2 is expected to be published by end November 2025.

- 📊 Reporting process overview: An ESRS report begins with a materiality assessment, evaluating ~100 predefined ESG topics for relevance—both from an inside-out (company impact) and outside-in (external risks/opportunities) perspective. Based on this, companies define their reporting scope and required data points.

- Mandatory disclosures: ESRS 2, Optional modules: E1–E5 (Environment), S1–S4 (Social), G1 (Governance)

- Report volume: Should align with financial reporting scope

- 📝 Timing & verification: Reports are submitted alongside financial statements and must be audited. Working with advisors and ESG software tools enhances credibility and efficiency. It’s recommended to align the materiality results and reporting scope with your chosen audit firm before data collection begins.

- 🛡️ GRI compatibility: Companies currently reporting under GRI enjoy transitional protection and may reference GRI content for many topics.

- 💡 Practical advice: Start collecting complex data early - such as GHG emissions, waste/circularity, water, and social workforce metrics. For the rest of the ESRS implementation, it’s advisable to wait until July 2025 (draft V2) or spring 2026, when the revised standard and initial best practices will be available from EFRAG.

GRI - by Global Reporting Initiative

Developed in the context of the United Nations, the GRI Standard has been available for over three decades and is widely adopted by large corporations worldwide. It is

continuously updated by the independent Global Reporting Initiative. Relevant topics are selected through a materiality assessment involving stakeholders—similar to ESRS.

Exceptions apply for industries with existing GRI Sector Standards.

📚 Structure The GRI framework consists of:

-

Universal Standards (GRI 1–3)

-

Topic Standards: Governance (200 series) Environmental (300 series) Social (400 series)

🔄 Ongoing updates Since 2024, key ESG topics are being addressed in a more integrated way.

GRI 101 Biodiversity (effective 2026)

GRI 102 Climate Change (effective 2027)

GRI 103 Energy (effective 2027)

These new standards replace parts of the 200–400 series, including well-known modules like GRI 302 and GRI 305. GRI continues to evolve while maintaining compatibility with ESRS.

- 🏭 Sector-specific standards Available for selected industries, including:

Oil & Gas (GRI 11), Coal (GRI 12), Agriculture, Aquaculture & Fisheries (GRI 13), Mining (GRI 14) More sector standards are in development.

✅ Summary GRI is not lightweight—but it is versatile, stable, and globally recognized. It offers a comprehensive framework for transparent and comparable sustainability reporting.

You can explore the full standard set on the GRI website.

SDG - compass along UN SDGs

A globally recognized guide for integrating the UN Sustainable Development Goals into business strategy

The SDG Compass is a simple yet powerful tool that helps companies understand the UN Sustainable Development Goals (SDGs), identify relevant topics, and embed them into their strategic planning.

📌 Five-step approach:

-

Understand

-

Prioritize

-

Set goals

-

Integrate

-

Report & communicate

⚠️ Note: The SDG Compass is not a reporting standard with detailed metrics or comparability for audits or client disclosures. For formal ESG reporting, it refers to frameworks like GRI, ESRS, etc.

💬 Communication advantage: The SDGs have been globally promoted by the UN for years and are widely recognized by the public. This makes them a highly effective tool for engaging stakeholders on sustainability topics—especially in external communication.

However, for trade fairs, investor decisions, or formal reporting to clients and auditors, the SDG Compass does not replace a full ESG reporting standard.

GSTC - Standards of the Global Sustainable Tourism Council

Tailored specifically for the tourism sector, with dedicated versions for hotels, tour operators, MICE, and tourist attractions.

- 🌍 Why it matters ESG is becoming a key competitive factor for end customers—and increasingly tied to tourism funding programs with sustainability requirements.

- 🌐 International meta-standard GSTC is a globally recognized framework that often acknowledges national standards. In some cases, national certifications are derived from GSTC criteria.

- 🔗 Direct link to SDGs and the UN 2030 Agenda GSTC aligns closely with global sustainability goals, offering a structured path for tourism businesses to contribute meaningfully.

- 🧭 What GSTC requires A systematic, auditable sustainability strategy Deep sector-specific understanding Participatory processes involving stakeholders—these require effort and dialogue

- 🤝 GSTC standards are best suited for Tourism networks aiming for international positioning through shared sustainability standards. For local communication, national labels like Austria’s Umweltzeichen may offer stronger visibility.

Gemeinwohlbilanz by Gemeinwohlökonomie

Widely known in Germany and Austria, the Common Good Balance Sheet (Gemeinwohlbilanz by GWÖ) helps organizations document and evaluate their societal impact across five core values:

-

Human dignity

-

Solidarity and justice

-

Ecological sustainability

-

Transparency

-

Co-determination

📋 How it works The process involves a structured assessment across 20 value-based topics, resulting in a points-based evaluation. Certified Common Good consultants can support the process, which may also be externally audited and published.

🌍 Linked to the SDGs The framework includes a mapping logic to the UN Sustainable Development Goals, making it a powerful tool for sustainability communication.

💡 Strategic value The Common Good Balance Sheet is a practical instrument for engaging with sustainability, setting meaningful goals, and communicating progress. Like the SDG Compass, it is not a metrics-based reporting standard and does not replace frameworks such as GRI, VSME, or ESRS.